OH SKAT – it’s that time of the year AGAIN – the tax time

DARLING – is what the Danish Customs and Tax Administration’s name actually means in Danish much to the amusement (or not) of Danes!

The article continues below.

By Bente D. Knudsen

Whether Skat is a darling or not, certainly at this time of the year, depends on whether you are getting money back from SKAT rather having to pay more to them!

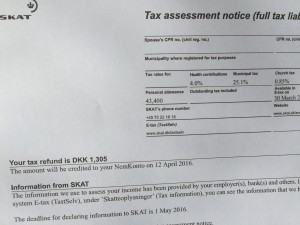

The Tax Assessment Notice, in Danish Årsopgørelsen, is sent out before 1 May to enable you to go through all the information, which SKAT has about your income and tax deductions for 2023.

You can still change it up until 1 May 2024.

This is the official deadline for ordinary taxpayers to declare their income (if you have your own company, or your spouse does, the deadline is 1 July 2024).

The article continues below.

The Danish tax system is progressive, meaning that the higher your income, the higher an amount of tax you have to pay.

This principle is reflected in the proverb: “Those with the broadest shoulders should bear the heaviest burden”.

In Denmark everyone is taxed individually and SKAT actually knows a lot about us already as they receive a lot of information automatically ;for instance your employer provides information on your pay; the bank provides information on interest income and expenses, while unemployment funds and unions provide information on membership fees etc.

As a result, you need to provide very little information personally.

The article continues below.

CHECK your TAX Assessment NOTICE

You can see your tax information by logging on to E-tax at skat.dk/English (click ‘Log on’ in the top right corner). You log on using your Nem ID or E-tax password.

However, it is recommended to check the information in the statements you receive from SKAT. Particularly the yearly Tax Assessment Notice is important.

In a country where the individual tax payment is high, the tax deductions everyone with an income is entitled to are important; having deductions means that you can earn a certain amount of money without having to pay tax.

If you are married and do not use all of your deductions and allowances, they (or what is left of them) are transferred to your spouse.

This is particularly relevant if one of you has no income.

Always check that your spouse’s unused deductions have been transferred to you.

The article continues below.

DID they get your deductions RIGHT?

Danish tax experts recommend that you always check the calculation that SKAT has used to calculate your deduction for transport between home and work. For every km above 24 km per day (calculated as more than 12 km for each trip (that is home to work and work to home) there is a fixed amount you can deduct.

The actual transport expenses and the means of transport are irrelevant. However, SKAT may have used what is called the “fugleflugtslinie”, the bird flight distance from your home to work, which may be shorter than the actual distance you have when driving or taking the train.

It is always possible to contest SKAT’s calculation and change it in your tax assessment notice to the actual km you have measured you use. The 2023 deduction per km per day for a distance of 25-120 km is DKK 2.19 per km and less for the km above 120 km (DKK 1.10 per km), take note that there is no deduction for the first 24 km !

Also SKAT uses an average number of working days, maybe your’s are different this year due to the pandemic with more days working from home than from the office, so check how many working days they used in their calculation.

The article continues below.

Special service deduction

The service deduction for work and services performed for you in your homeis an amount each person can deduct for work performed in the home – notice the amount is an individual amount – so for married couples remember you have the double amount.

Unfortunately, SKAT has no information in English about it on their website – Danish only.

The deductible amount in 2023 is for services and for certain improvements in your home ( rented or owned).

It is only possible to get a deduction for wages – not for materials and supplies, and the work performed in your house must be on the list of approved services.

It should have been paid for before 28 February 2024.

Take note that in 2023 the amount is DKK 6,600 for house/gardening help per person. In 2024 it has been increased to DKK 11,900 per person.

The list is independent of whether or not you own or rent, however, you must be responsible for maintenance of the home you are renting.

For instance you can deduct wages from a person or business that has cleaned your house, or helped with washing of clothes, curtains or carpets, window polishing, gardening, and also babysitting can be deducted, whether in the home or after school/kindergarten hours.

Notice that help with homework cannot be deducted!

A condition is that the payment has been made digitally directly to the person or business’s bank account – so cash payment is not accepted as a base for deductions, and an individual person must be above the age of 18 and have made a declaration of employment with full CPR number and address.

You cannot deduct wages for people living in house, so the cost of an au-pair does not count.

For regular maintenance and repairs of your home, such as painting or other renovations only wages from people employed by a business entity with a CVR number can be deducted.

Check the list on SKAT’s homepage here: list services – the håndværkerfradrag

The article continues below.

What does SKAT know?

Your tax assessment notice was available in mid-March in E-tax at skat.dk/English.

The tax assessment notice contains the information which SKAT holds about your income and deductions and allowances for the year that has just ended.

You need to enter any missing figures and correct any incorrect figures.

This is what SKAT has:

- Your pay

- Your interest income and interest expenses

- Membership fees to unions and unemployment funds

- Information about your property/properties for calculation of property tax, (in Denmark)etc.

If you change your information, you will receive an updated tax assessment notice.

The tax assessment notice tells you whether you have paid the correct amount of tax in the year that just ended, if you have paid too much tax and are entitled to a refund and worst case of course if you have paid too little tax and must pay outstanding tax.

If you have paid too little tax, you need to pay the rest of the tax you should have paid. If you have paid too much, the amount of overpaid tax will be refunded to your bank account automatically.

Source: SKAT.dk. Your Danish Life has taken every care to ensure that the published information is correct, however as SKAT is a complicated matter in Denmark, Your Danish Life is not liable should the above information not be correct due to a reader’s personal tax situation.

Ask your local tax office for help or ask in one of Work in Denmark’s International Citizen Service centres.